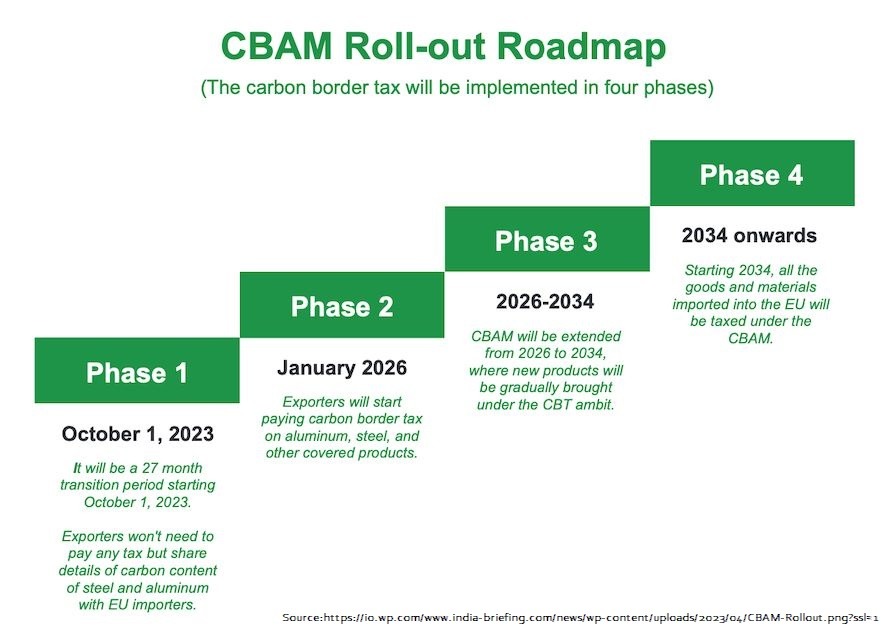

The European Union’s Carbon Border Adjustment Mechanism (CBAM) is a groundbreaking policy addressing global climate change while reshaping trade dynamics. Introduced in October 2023, this mechanism imposes carbon taxes on imports based on the carbon intensity of their production processes. By 2026, the CBAM will impose taxes ranging from 20% to 35% on specific imports, marking a significant shift in international trade. This article explores CBAM’s implications for India and outlines strategies to mitigate its impact.

Table of Contents

What is CBAM and How Does It Work?

CBAM is part of the EU’s “Fit for 55” package, designed to reduce greenhouse gas emissions by 55% by 2030. The mechanism ensures that imported goods are subjected to the same carbon costs as products manufactured within the EU. This prevents carbon leakage—where companies relocate to countries with lax environmental regulations—and encourages non-EU nations to adopt stricter environmental policies.

Under this system, EU importers must calculate the greenhouse gas emissions embedded in their products and purchase CBAM certificates equivalent to these emissions. The pricing of these certificates is linked to the EU Emissions Trading System (ETS), ensuring alignment with domestic carbon pricing.

Implications of CBAM for India

India’s reliance on coal, which accounts for 75% of its energy consumption, makes its exports particularly vulnerable to CBAM. Products such as iron, steel, and aluminum—key contributors to India’s EU exports—face carbon levies ranging from 19.8% to 52.7%. Starting in 2026, these taxes will apply directly to imports, potentially reducing the competitiveness of Indian goods in the EU market.

Moreover, CBAM will likely expand its scope to other sectors, including refined petroleum products, textiles, and chemicals. Without a domestic carbon pricing mechanism, Indian exporters may face steeper tariffs compared to nations with established carbon pricing policies.

Strategies for Mitigation

To mitigate the challenges posed by CBAM, India must adopt a multi-faceted approach. Firstly, integrating decarbonization principles into existing policies, such as the National Steel Policy, can help industries transition to greener production methods. Incentivizing cleaner energy use and technologies will align with global sustainability goals while boosting export competitiveness. Read about Local solutions to tackle Climate Change here.

Negotiations with the EU are another critical step. India could advocate for recognition of its existing energy taxes as an alternative to carbon pricing, thereby reducing the carbon levy on exports. Additionally, pushing for EU support in technology transfers and financial mechanisms can accelerate India’s transition to low-carbon manufacturing.

Finally, India must leverage international platforms such as the G-20 to unite developing nations against unilateral trade measures like CBAM. This collective advocacy can help ensure that global climate policies are equitable and inclusive.

Conclusion

The EU’s CBAM reflects a shift toward integrating environmental accountability into trade policies. While its objectives of reducing global carbon emissions and promoting fair trade are commendable, the mechanism poses significant challenges for developing nations like India. By adopting decarbonization strategies, negotiating equitable terms, and advocating for global fairness, India can navigate these challenges and secure its place in an increasingly sustainable global economy.

FAQs

What is CBAM?

CBAM is a carbon tax mechanism introduced by the EU to levy taxes on imports based on their embedded greenhouse gas emissions.

Why is CBAM important?

It aims to reduce carbon leakage, promote fair trade, and encourage stricter environmental policies globally.

How does CBAM affect India?

CBAM imposes significant tariffs on India’s exports, particularly in sectors like steel, aluminum, and cement, potentially impacting competitiveness.

What steps can India take to mitigate CBAM’s impact?

India can adopt decarbonization policies, negotiate with the EU for equitable terms, and promote greener production methods.

How does CBAM align with global climate goals?

By holding all producers to the same carbon cost standards, CBAM fosters a global shift toward sustainable production and reduced emissions.